Trade idea - just an idea

2024.03.08

We advocated that it would be a good idea to have Yen in a well diversified portfolio in earlier publications and also our opinion was reflected in a few other reports like “reflection of the day”. Suggest read back in time in this website. We’ve been constantly advising our clients about the Yen when ever above 150 to the $. But also EU reference currency is in the same position. While the FED and the BCE are pondering reducing interests, Ueda BoJ, is pondering the contrary.

2024.03.06

Investors who still maintain a large junk of top tier performing equity e.g. magnificent 7 (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and finally Tesla-not sure it still belongs in in there) might/should ask themselves mainly 3 things:

- Valuation metrics

- Geo-political risk

- Take some profit and switch to value?

2024.03.01

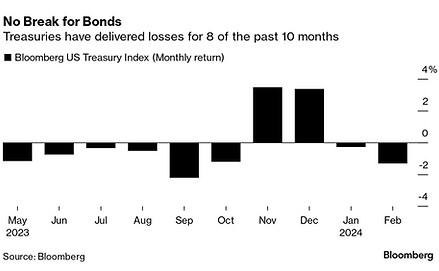

Since quite some time we have had the idea of going long bonds 20y+ (TB) with the last push in October 2023 in TLTs.

We had a good run for two consecutive months and since Dec 23 we gave up some gains. For conservative investors we still like the idea. We do not see an increase in FedFunds , we never saw a swift easing either. Now the market starts estimating what we suggested in 2023 i.e. easing in towards the second half of 2024.

2024.02.27

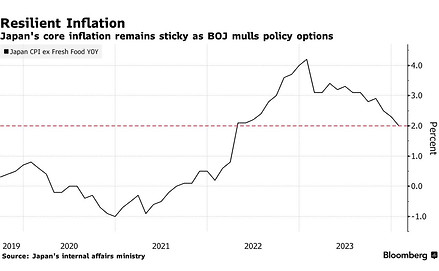

Following up on our ideas of the last months, having Yen is most probably a smart move for a diversified portfolio.

Japan’s benchmark inflation topped estimates in January, supporting the case for the central bank to scrap its negative interest rate in the coming months.

Bond yields jumped after consumer prices excluding fresh food rose 2% from a year ago, in line with the Bank of Japan’s inflation target. The two-year note yield climbed to the highest level since 2011 after the data from the internal affairs ministry Tuesday exceeded a consensus estimate of 1.9%.

The report is adding to speculation that the BOJ will end negative-rate policy as early as March (1 semester more likley) and is serving as a selling catalyst for bonds. The January CPI report underscores persistent inflationary pressures.

2024.02.15

The idea , as suggested during the 4th Q 2023, is to buy the yen at this level (use stop-loss) looking for $/Y 132. The market expects further wage inflation in 2024. This could result in a normalisation of BOJ policy and Yen strength .

Risks are plentiful , particularly the potential of US resurgent inflation and consequently high interest rate differential to the JPY.

2024.01.05

Not that we are all to bearish on the USD , that has lost quite some value against most of its peers lately, but USD/YEN is another story . We maintain our bullish stance for JPY.

2023.11.08

When war breaks out in the Middle East the first impulse for everyone is to assume oil prices will rise.

This is the case, even when the conflict doesn't involve any oil-producing areas. After Hamas's Oct. 7 attack on Israel, the price of crude instantly jumped. Perhaps it reflected concern the conflict will widen across the region (still possible) or expectations for more forceful sanctions against Iran. Or possibly it was just reflex.

Either way, the move has way more than unwound. As of this 1pm38 EU central time, Brent crude is close to $80/barrel or -20% from its recent high end September 2023.

Wholesale gasoline are now at their lowest level of the year, thanks to both the decline in oil prices, and refiner margin compression.

Again, obviously anything is possible in terms of the war broadening out. But clearly, it’s not what most people might've anticipated one month ago.

Meanwhile, it might be time to watch again what the White House does with refilling the SPR and whether it will engage in anymore "short covering" after selling off a substantial amount near the peak.

We are watching closely end May/beg June levels to enter the market.

Source: FT, Bloomberg, DC

2023.11.02

The world’s 13-year experience with negative-yielding debt is drawing to a close as the BOJ gradually moves to tighten policy. Bloomberg’s index of bonds with sub-zero yields peaked at $18.4 trillion on Dec. 11, 2020, with more than 4,600 securities. Now, only one security—a Japanese government note due in December 2024—briefly traded at 0% today, versus minus 0.001% yesterday. The idea of having JPY vs USD is valid as ever, like we posted in the recent past.

2023.10.30

During the WE (Oct 28/29) we had long conversations with some interesting people about fixed income, and we insisted that TLT (ishares ETF 20+ Year Treasury Bond) was a good idea to have in your portfolio as posted recently. There today’s the idea is to increase the position by another third (2/3) of the intended position.

2023.10.14

The bullish appetite makes sense when you think of basic investing math. With yields on 20-year Treasuries hovering near 5%, a drop of 50 basis points would deliver a total return of more than 11% over the next 12 months, according to data from F/m Investments. On the flip side, a 50 basis point rise would only result in a loss of about 1.1%.

The risk-reward for duration (time of the bonds life or remaining life until maturity) is extraordinarily favourable right now and it’s just the bond math. If the Fed just decreases fed funds slightly in 2024 (we think 2nd half) from here for the 10-year, we can talk about a double-digit total return in long bonds that no has been seen literally in years.

That logic has helped investors keep the faith through a brutal year for bond bulls amid elevated price pressures and increased Treasury supply. The $39 billion iShares 20+ Year Treasury Bond ETF (ticker TLT- vide recent trade idea to go long this ETF after losses on our very long bond position)) has attracted a record $17.6 billion so far this year. That idea is still in play.

2023.10.04

We did have the idea of going very long quite some time ago, and we are meanwhile underneath our average purchase price. But you do not buy 30Y Bonds if you are in a hurry to sell. You keep them because you have a long term investment horizon. (although we believe and in a few years from now you’ll be in the green.

In addition to single bonds, today’s is to start positioning in iShares 20 Plus Year Treasury Bond ETF < $85.- 1 third of intend total position, as usual.

2023.10.03

China and its real estate troubles

China’s economic recovery remains precarious, with data showing some mixed signals as the manufacturing sector tries to gain momentum. On top of the existing problems with China’s cash poor , highly indebted construction companies, we note the following addition in the respective chain. Excavator sales — a leading indicator for construction activity — have yet to recover, down 43% this year after a 45% drop in 2022.

“Activity indicators such as property gauges, excavator sales and cement output remain weak, yet given the raft of support measures announced, these may start to recover slowly,” Bloomberg Intelligence wrote in a note.

2023.10.02

Brent crude fell below the stop-win of $94.- If you did follow the idea buying crude mid year in 3x a third for your intended position, your average purchase price was around $75. Sold at $94.- you’re looking at aprox. 25% profit in less the 6 months.

2023.09.29

Raise stop-win to 94.-/bbl

2023.09.25

As a follow up notice on our trade idea we notice that Hedge funds piled on bets that tightening crude supplies will see a resumption of the rally after a pause last week.

*our idea related to brent but the price development is similar, albeit +$5

Money managers increased their net long WTI bets by 15,084 lots, according to the CFTC. The last time funds were this bullish was before Russia’s war on Ukraine, which sent oil prices and volatility soaring.

The positioning marks a major turnaround from the gloom in the first half of the year, when the group held the most bearish stance in about a decade.

2023.09.20

Bank of Japan governor Kazuo Ueda said he has “yet to foresee” inflation settling at the target level of 2 per cent, deferring market expectations that the central bank was nearing an exit from decades of ultra-loose monetary policy and sending the yen tumbling. Ueda’s comments on Friday followed the BoJ’s announcement that it would maintain its easing stance, including the world’s only negative interest rates, at the conclusion of a two-day monetary policy committee meeting.

In a well diversified portfolio, the idea is to add a Yen long position 1 out of 3 at these levels (USD/Yen 148) . Inflation is still on and will continue to be “on”.

2023.09.20

In spring the trade idea was going long crude at <$80 with a target of $95-$100/barrel. $95 was reached yesterday, but gave up a bit to $94.50. We still believe that $100 is very probable as the world consumes more than what it produces. Closing in near $100, we suggest to put the stop-win order at $95.

2023.09.19

The time could be ripe to increase long fixed income instruments, as we have suggested in the past. After a four-month selloff, as the US central bank is close to signalling its hiking cycle ma be close to an end over and some ease could kick in in the second half of next year, driving the benchmark yield as low as 2.5%. In addition to very long bonds, idea of the last two suggestions, the risk-reward to us looks attractive to own 10-year yields at today’s levels.

2023.09.14

In the spring of this year, we suggested to go long crude oil <$80 with a end year target of $95-100. This is still in play. Crude presently is at $92.38 and we would suggest to protect the profit by setting a stop-win order at $91.-

2023.06.12

Increase long crude oil 3/3

2023.04.05

Mid 2022 we reckoned that a purchase in very long bonds would be a good idea. The chart below does indicate that the idea to further increase very long bond position is still in play.

2023.03.31

Increase long crude oil 2/3.

2023.02.16

At actual prices we would start a long position of crude (<$80) target within this year $95-$100.