Chart of the day

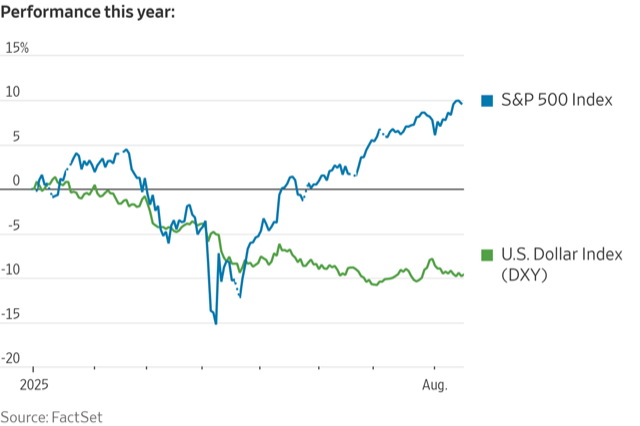

Dollar down 10%, S&P 500 up 10%

Does this make you bullish for the US$?

Euro-area inflation held at the European Central Bank’s target, supporting the case for officials who say there’s no rush to keep lowering interest rates. Consumer prices rose an annual 2% in July, the same pace as in the previous month, Eurostat said. Economists polled by Bloomberg had expected a slowdown to 1.9%. A core measure stripping out volatile energy and food costs increased 2.3% on the year, while closely-watched services inflation was the weakest since early 2022.

Will ECB (European Central Bank) follow suit?

Not only is Nvidia now worth more than Microsoft and Apple, the only other companies to ever reach a valuation above $4 trillion, but its market cap exceeds the COMBINED value of Alphabet and Meta, two tech powerhouses in their own right. Looking further, Nvidia is worth more than Amazon, Walmart and Costco, the world’s three largest retailers, combined.

Several months ago we advocated for a “higher for longer” strategy from the FED and have stressed this point in various posts in this website. Again, the bond market seemed to reflect bets for a higher-for-longer U.S. rates scenario, with the two-year Treasury yield notching a two-week high. At the same time , for the ones that do not surrender to FOMO, why keep all that equity at record highs if you can get an easy 4.5% p.a. ?

"Faites vos jeux" (place your bets)

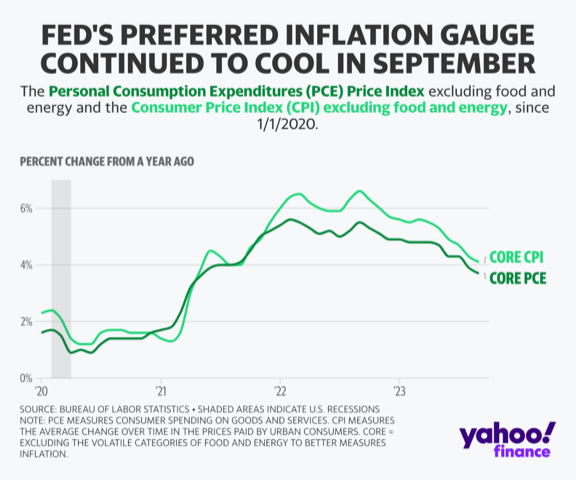

Our stance of holding long fixed income and TLTs is further confirmed by smallest underlying price pressures.

Another dismal showing of the private-sector economic activity may suggest a mild recession for the second half of 2023 for EU. EU’s purchasing managers’ index slowed to a three-year low in October, dropping to 46.5— clearly below the 50 mark that separates expansion and contraction. Economists expected a slight improvement to 47.4. We did anticipate this possibility by publishing our cartoon on September 12th (vide cartoon of the day). We have been advising against holding to much € as we

The chart can be worrisome however, we believe the most potential buyers are targeting a shorter fix mortgage, or even variable…around 5% p.a.. Lower but still higher some very short time ago…. Note that existing home sales dropping to a 13-year low in September.

Adding to our yesterday’s reflection mentioning China’s deflationary tendency, it’s stock market performance in the last 2 years is certainly not brightening the picture.

Our most recent assessment regarding EU interest rates was correct. The ECB pressed the pause button, but left the door open to further interest-rate hikes should inflation fail to ease quickly enough. Rates were unchanged, for the first time in more than a year, with the deposit facility rate at 4% and the main refinancing rate at 4.5%.

While we believe that the ECB will hold interest rates where they are, EU economic growth is stalling (to say the least) and macro-economic data for the US is positively expanding, the USD/€ exchange rate is poised to tend to parity.

At some point, the main driver of US economy , consumption, will have to throw the towel and with it, the FED stalling or cutting.

Today’s EU zone inflation numbers, as expected, show a cooling 2.4% Y-o-Y November, down 2.9% from the prior month. It’s a fresh two-year low, getting closer to ECB’s target of 2%. One week ago, we published a paper about dismal numbers of the EU economy, already indicating slower growth and more weakness in the labour market. We did raise the idea for longer bonds allocation.

Following to our report on the importance of asset allocation, we thought we take another look at it :

Time to arbitrage?

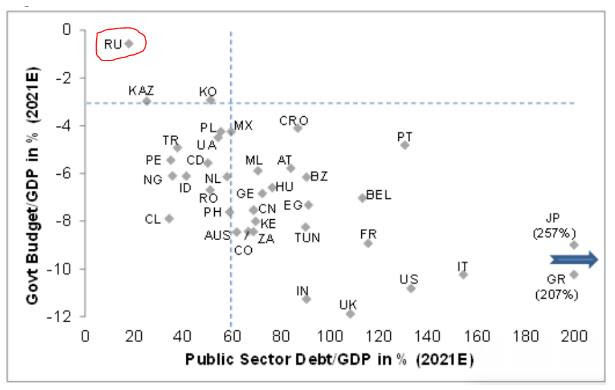

Again, we should call it “graph” of the day. Quite interesting how the acronym BRIC (Brazil, Russia, India and China) is shining what refers to economic growth . With exception of Russia, obviously, the year 2023 will end with a respectable increase in GDP , barring any major “black swan” event in Q4 of this year. India not only surpassed China this year in population, but also in GDP. Food for thought?

We believe, as mentioned in the recent past, that inflation is “stickier” than what investors are wishing for. We do not believe that a interest rate cut is in the cards for this year.

“There is never just one cockroach in the kitchen” - Warren Buffet

Looking back at some of our papers and reflections, we have reckoned that a slowing US economy was on the table. Today’s chart seems a further confirmation that it (US economy) is headed towards a slowdown. A mild recession cannot be ruled out and a stalling of FedFunds rise after today, neither.

Private equity over ? Not quite……. Globally, private capital firms were still sitting on a record $3.7 trillion of unspent cash at the end of 2022, more than treble the amount they held in the industry’s last boom years before the global financial crisis.

Is the S&P 500 just USA ? No…..

Concerned? No? You should be…….