Reflection of the day

2024.09.26

The magical thing about the times we live in is that there's always a good reason to buy the market.

- Rates are falling? You have to buy because the economy will be stimulated and inflation...well, that's not so bad.

-Rates aren't coming down? Buy anyway, because it means the economy is strong.

-Jobs are rotten? But you have to buy, because that means they're going to lower rates.

-economy's not doing well? Buy because AI will save growth.

And the latest from yesterday: consumption is collapsing? Buy now, because China is about to start up again with a crazy stimulus plan! (Not that its going to last in our view)

2024.09.24

Chinese stocks may have finally received the sustainable boost they needed. Policymakers are throwing the kitchen sink at the economy, which is exactly what markets needed. This may be China’s whatever it takes moment.

While more interest-rate cuts were broadly expected, as was the easing of lending restrictions on the housing market, the main surprises are the direct support for equity markets and policymakers coming out as a united front. Allowing funds and brokers to tap PBOC funding to buy equities will lend a huge assist to the beleaguered stock market. This shows the broader commitment by policymakers to stem the rout in equities, beyond the regular support from the so-called national team. The impact of measures to spur M&A is another positive in reigniting animal spirits and anemic business investment.

How much this prompts inflation and supports consumption may be more questionable given how much of household wealth has been depleted. It will come down to how effective the buying of unsold homes is and a necessary recovery in house prices. That may take a bit longer to see visible results. While the devil may be in the details, the sentiment boost from the barrage of headlines is much needed.

Source: Bloomberg

2024.09.23

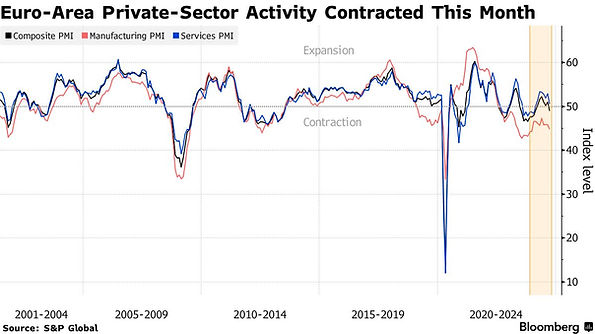

The euro area’s private sector economy shrank for the first time since March, PMI data showed, casting a shadow on the bloc’s economic recovery.

Germany’s manufacturing woes worsened and France’s services industry contracted in September. Composite PMI readings for both economies missed expectations.

The euro zone’s teetering economy is spurring bets on more aggressive ECB cuts. The reflection this begs: EUR/USD QUO VADIS?

2024.09.11

Energy Affordability

When Russia invaded Ukraine in 2022, sending energy prices surging, it worsened what was already a budding inflation crisis across most of the world. In the US, the Biden administration for a time took to calling it “Vladimir Putin’s price hike.”

Now, oil is again playing a prominent role, this time in helping spur disinflation. Brent crude fell below $70 a barrel for the first time since late 2021 on Tuesday, promising households greater energy affordability in coming months.

Some observers — including Citigroup, JPMorgan Chase and one of the world’s largest commodities traders — have raised prospects of a drop toward $60 a barrel in 2025. That could bolster the chances of the US and its peers weathering the effect of high borrowing costs without a damaging recession, and make it all the easier for officials to cut interest rates.

Source: Bloomberg Economics

2024.09.06

Oil's worst week in a year

Oil is starting down its worst week in more than a year, after bullish news on U.S. inventories failed to inspire gains in a market that seems more fixated on economic worries. Brent crude could really use a strong payrolls report to avert falling below $70 a barrel.

Graphics are produced by Reuters.

2024.08.22

The recovery on the stock markets has been as rapid as the downward trend. After losing 8.3% of its value within a few days at the beginning of August, the MSCI world share index is currently trading just below its record high of July 16. The Nikkei 225 in Tokyo, which was at the center of the excitement, even fell by around 25% relative to its July high - since then it has recovered 20%.

Global equities: the record high is within sight

Bloomberg

What was behind the downward pressure? Slightly weaker US labour market figures, falling purchasing managers' indices, some disappointing results from technology companies and the Bank of Japan's interest rate hike from 0.1% to 0.25% led to an abrupt deterioratin in sentiment on the stock markets. This was exacerbated by the low trading volumes during the summer vacations.

After somewhat better economic data and after exponents of the Bank of Japan vowed that they would not raise interest rates any further for the time being, sentiment turned and the stock market barometers trended upwards again.

The calm after the storm?

A positive side effect of the nervous phase was that it led to lower interest rates and that both crude oil prices and the dollar have recently weakened. This provides relief for consumers and borrowers, which supports the global economy.

So everything is fine?

Not necessarily. Although the rapid return of calm is pleasing, it is by no means certain that it will last. Various risks harbor the potential for further shocks on the financial markets.

2024.08.12

One must appreciate John Plender’s latest column for the FT which posed the question: as the macroeconomic balance shifts and monetary policy responds, how much fragility will be exposed, how many trades will unwind?

This all marks a step change in the evolution of the business cycle. During this century and within the memory of most people on today’s trading floors, recessions have been precipitated by financial booms turning to busts. Central banks have then acted as lenders and market makers of last resort to address the resulting financial instability. Such action has taken place against the background of quiescent inflation courtesy of globalisation and the erosion of the pricing power of labour and companies. In the 1980s and 1990s, by contrast, recessions were induced by a tightening of monetary policy to bring inflation under control. Because financial institutions were more heavily regulated there was less financial instability. Inflation was the chief yardstick for judging the sustainability of economic expansions, as opposed to financial imbalances. A combination of the pandemic and the war in Ukraine has created economic circumstances very similar to the late 20th century. But thanks to financial liberalisation the scope for financial upsets in a monetary tightening cycle is much greater, as the collapse of Silicon Valley Bank and others showed last year. How much more financial vulnerability might be exposed in this cycle is an open question. Because of the long period of ultra-low interest rates since the 2008 financial crisis, much private sector borrowing has been at fixed rates and long maturities, so credit stress from the sharp interest rate rises of the past two years has been delayed. And then there is huge uncertainty around the extent of risk taking in the burgeoning non-bank financial sector. There are nonetheless grounds for regarding the setback in equities as a healthy correction. Market buoyancy this year has been overdependent on hype around artificial intelligence in the so-called Magnificent Seven tech stocks. Note that Elroy Dimson, Paul Marsh and Mike Staunton in the UBS Global Investment Returns Yearbooks have established that over more than a century investors have placed too high an initial value on new technologies, overvaluing the new and undervaluing the old.

2024.06.18

"If you are Meloni or Le Pen, they’re thinking — either I could exit the euro or I could try to make a difference while I’m here. They’re politicians. You might not agree with them but they’re not stupid."

2024.06.18

2024.04.16

ECB has cut rates. The next move is about to come from the Fed. With employment data taking any chance of a summer rate cut off the table , the focus will largely be the Fed’s dot , issued quarterly, in which each FOMC member gives their prediction for the future course of fed funds, and for various economic measures. Last time, the median participant envisaged three cuts by the end of this year — although only one member would have needed to change their mind to move the median to imply only two cuts. It would be a major surprise if that doesn’t happen this week, with the fed funds futures market now implicitly predicting slightly less than two cuts by year-end. The key question now, with the Fed median currently 34 basis points below the market’s prediction, is whether the median member shifts to predict two cuts, or moves all the way to expecting only one. Our forecast is less cuts than the market expects as we believe in a persistent resilience of the US economy:

Source: Bloomberg World Interest Rate Probabilities, Federal Reserve

If the FOMC does move the dots that far, it will complicate life for everyone else. This descent is going well so far, but the hazards aren’t over. It was never going to be easy.

2024.04.16

The following chart could be an indicator why the low manufacturing ISM numbers and weak GDP could be a predictor of a looming recession (grey shaded columns).

2024.06.03

Look around the world and ask yourself the following questions:

Q: The war in Ukraine hangs in the balance. Who ought to be most concerned? Europe. If Putin wins, whose strategic model will be most disrupted?

A: Germany.

Q: The American election hangs in the balance. Who ought to be most concerned? Europe (see above). And if Trump wins, who, in Europe, will be most disconcerted?

A: Germany.

Q: The future of the green energy transition is in the balance. Whose industrial base is most in the crosshairs of Chinese competition? Europe. If Chinese EV sweep the board, who, in Europe, will be the biggest loser?

A: Germany.

Q: The European economy look as though it may be sliding towards stagnation and lags far behind in key areas of innovation. Who has suffered particularly grievously from the triple shock of COVID, Putin’s war and the gear shift in Chinese growth?

A: Germany

2024.04.26

U.S. core personal consumption expenditures (PCE) price index data for March - the Federal Reserve's preferred measure of inflation - takes centre stage later today, Friday.

Any upside surprises could again derail the timing for Fed rate cuts, with the first currently expected to come in September.

That the U.S. economy is holding up this well in the face of decades-high interest rates is somewhat astounding.

While the country's Q1 GDP (1.6% vs. 2.4% expected) missed expectations, that was due to a surge in imports and a small build-up of inventories. Domestic demand, however, remained strong, business investment picked up and the housing recovery gained steam.

Given the recent run of solid U.S. economic data, the narrative has changed (as written in previous papers) not just to when the first rate cut could occur, but whether rate cuts may even come at all this year.

2024.04.16

We would suggest to take the following information “with a grain of salt”…

2024.04.12

Since last September (vide cartoon of the 12th) we have been raising doubts about EUs economy to rebound if not stagnate or even recede. At the same token , we have been writing about the US economy’s resilience and sticky inflation. 6 months later , and several adjustments downwards for a interest rate cut from economists and bankers, the time of reckoning (at least partially) has emerged.

2024.03.28

Despite the euro zone having lower official interest rates and a notably softer economy than the US, the euro has held up remarkably well against the dollar. The FOREX market’s most traded currency pair trades not just in line its $1.085 average of the past year but within reach of the $1.11 five-year mean.

The EU currency, however, can’t defy gravity forever — so a return toward parity with the greenback looks more likely than not over the course of this year.

The two main drivers of currency values are relative central bank interest rates and respective growth outlooks. Both are fading faster in Europe than in the US.

It's not just about absolute measures, but how those respective differences contract or widen are what typically influence the foreign exchange market. On both measures, the US position looks superior, with the dollar also underpinned by its status as the world’s (still) reserve currency.

One other salient factor is investor positioning. Bank of New York Mellon Corp.’s proprietary iFlow system tracks its global custody client holdings which, worth $46 trillion, are the world's biggest. On balance, clients remain overweight in euros. The bank’s senior strategist expects euro-dollar parity to return, not just due to fundamental economic and monetary reasons but because investors are shifting rapidly from being extremely long of euros to sell them when smoke rises.

US and Euro Zone Economies

While the US may suffer slightly higher inflation, its economy is far more robust

%2016_58_55.png)

Source: Bloomberg ECFC survey

2024.03.23

Does the Fed’s economic upgrade hint to stable fed funds and no cut?

Ahead of the Fed’s meeting this week, everyone was focused on dots.

But the most important number offered by Fed officials was the FOMC’s surprisingly bullish expectations for economic growth, revised upward, as our Chart of the Week shows.

In December, the market cheered after hopes for rate cuts were restored following pleasing inflation numbers. But economic growth projections for 2024 had fallen to 1.4% from September’s 1.5% projection for 2024 GDP growth.

Now, though disinflation may have stalled in comparison to December, the FOMC projects 2024 growth at 2.4%, almost double forecasts from just three months ago. And with an optimistic Fed holding its expectations for three cuts this year — the most important old number — this confirmation that the economy is expected to stay strong has helped push stocks to new highs.

Will it also keep interest “higher for longer” ?

2024.03.18

Undoubtedly, the last 140 days have been marked by uncontrollable optimism. Ever since Jerome Powell hinted at the end of October 2023 that the FED might - even if it's not certain - STOP RAISING RATES, and might even consider lowering them, the markets have hardly stopped rising. All this on the assumption that rates were about to start falling, and everyone knows that the world's stock markets love falling rates. However, for the last 140 days, we've been bombarded with figures that don't really fit the scenario Powell is selling.

"Faites vos jeux - rien ne vas plus!"

2024.03.15

The US economy has proved impressively resilient since the Federal Reserve two years ago launched the most aggressive monetary-tightening campaign in four decades. Although retail is still holding tight, the longer “higher for longer” is maintained by the FED, the more will it show in consumption and other sectors.

Many middle-class families are increasingly pressured by the increase in servicing debt instead of going to the mall.

Delinquency rates, mentioned in prior publications, on CC and auto loans are the highest in more than a decade. For the first time on record, interest payments on those and other non-mortgage debts are as big a financial burden for US households as mortgage interest payments.

2024.03.11

Early this Monday I’m reafing the FT - unhedged by Armstrong and I lean very much on his side:

“Late last week Goldman Sachs released a report comparing today’s biggest, best-performing stocks to the big names from the 90s tech bubble and the “Nifty 50” stocks of the 70s. They found that the standout stocks today are at much cheaper valuations than the stars of the 90s were, and while the valuations of the Magnificent 7 et al do look a lot like the “Nifties,” they tend to have significantly higher return on equity. They also found high performance concentration in the index was not associated with subsequent declines.

This chimes with Unhedged’s house view. While stocks sure do look expensive, the market is well short of being properly bananas; but if you expect stock returns to be anywhere near as high in the next 10 years as in the last 10, you are properly bananas.”

2024.03.05

We wrote lately that Japan equities are near a “sell” idea and the Yen a “buy” idea. We are not the only ones. “The advance in the Asian nation’s market has been supported by yen depreciation, which in turn kept inflation elevated. Once the effects of these two are excluded, however, the rally looks far more modest and trails those in US and French peers.

So, Japanese shares need more than inflation and a weak local currency to extend the current outperformance. A shift in the global supply chain to Japan from China can be one of the positive catalysts, but it’s mostly thanks to geopolitical tensions between China and the US over Taiwan.

Japan’s equities look overvalued in historical and cross-market terms. And there appears to be little by way of strong local growth narratives to justify the lofty valuations. That leaves the country’s stocks vulnerable to a correction.”

2024.02.27

Traders are pricing more than 90 basis points of cuts from the ECB, which makes sense when you consider that the euro-area economy is expected to essentially stagnate this year, compared American growth that's forecast at 2%. Yet recent figures have delivered more positive surprises for Europe, while the momentum for US looks to be slowing down.

The recent message from the ECB has been one of a gradual start to rate cuts, similar to the Fed's. Yet unlike for the Fed, markets currently seem to think that once the ECB pivots to easing — potentially in June — it will spend most of the remainder of 2024 delivering more reductions.

For markets, the risk-reward seems to favor a bit of a rebound in German bonds, which have underperformed their Treasuries peers so far this year. That would certainly be the case if the ECB doesn't push back against the current extent of easing priced in. And even if policymakers do cast doubt on rate-cut pricing, they're unlikely to go the same lengths as their US peers, given the growth differential between the two economies.

2024.02.26

At current levels, the Nasdaq 100 is trading at a P/E of some 33x, and the S&P 500 is just following in tow. But when some of the best minds ( Buffet) in finance can’t deploy their cash, it may be time to turn a bit cautious.

2024.02.22

The earnings season so far has been disappointing. For the first time in ten years, European corporate earnings are below consensus forecasts. However, the bad surprises were only 2%, so there's no immediate cause for panic. The question is, however, how sustainable are margins at this stage of the cycle? We can expect a moderate slowdown in global economic growth ("soft landing") and near-stagnation in Europe. Under these conditions, it is unlikely that margin growth will be possible on a broad front.

2024.02.19

The four-year synchronization among developed-world central banks might be about to weaken as economic trajectories of Europe and the US diverge.

In the euro-area, price pressures are retreating, supporting the case for earlier cuts. But in the US, traders are embracing the Fed’s push-back against near-term easing bets.

JPMorgan strategists advise clients to play the US-Europe growth divide by preferring US equities, credit and the dollar as well as bunds.

2024.02.14

Yesterday’s US inflation numbers to the upside surprised most market participants .

For the medium term, a soft landing seems to be off the charts and a no-landing is again on the table. We do not believe that there will be rate hikes, but as written previously, rate cuts in the first half of the year very unlikely. The tick-up in inflation may be a blip. There’s plenty more data this week that could change the base case yet again.

If the US economy is really expanding too fast, that would show up in retail sales (due Thursday) and producer prices (due Friday).

WE would suggest a holding pattern. It would be unwise to make a bet against either a soft landing or an overheat.

2024.01.08

In spring 2021 we wrote about inflation being around the corner, when the Fed and the world didn’t see any. In spring 2023 we suggested to go long long bonds due to the steep rise in short term interest rates and its consequence to the US economy, culminating in 5% yield for the 10-y treasury, believing inflation would recede. We still believe that present high short rates will have a dampening effect , especially on the labour market (despite recent readings). Not so sure about “goldilocks” situation in 2024, however we do reckon a recession to be off the table…slowing economic activity still on. Short term interest will come down, but not as fast as priced in the market. Patient investors stay long fixed income.

2024.01.02

Rearview mirror

At the end of 2022 all across Wall Street, be it among equity or bond strategists, traders and economists , the mood was not to pop a bottle of champagne . It was rather a Prozac moment in a gloomy mood. Everyone seemed to brace for a recession they were convinced to be on their doorsteps. The biggest names, from JP Morgan Chase to Citi and al. the predictions were that the S&P500 was about to tumble and everyone advised their clients to prepare for a further tumble of TB yields.

The Chinese assets were seen as bullish after Beijing’s end to Covid-19 precautions .

These 3 predictions, sell US stocks, go long TBonds and go long Chinese equities were the general consensus on Wall Street.

But - and this is a big “but”, then came 2023. Things turned out exactly the contrary. So much for predictions.